96% of customers would buy from you again if you did this one thing, according to Narvar Consumer Report:

Provided an easy returns experience.

Results from a UPS survey align with that:

- 73% said “the overall returns experience impacts their likelihood to purchase from a retailer again.”

- 68% said “that the returns experience shapes their overall perceptions of a retailer.”

As refunds grow more prevalent and expensive for retailers, it’s time to take control and redesign your refund experience as a retention building strategy.

We’ll tell you how to do that exactly – specifically, with store credit that keeps the sale’s profit in your pocket – but first, let’s explore why change is even needed, especially during the holiday season.

$1 Trillion Dollar Loss from Annual Retail Returns

Let’s start with the bigger picture.

“Annual global losses from retail returns are nearly $1 trillion – up from $600 billion in 2015,” estimated Greg Buzek, founder and president of the research and advisory company IHL group, in 2019, according to Reuters.

The same year, CNBC reported findings from Optoro that explained some of the causes for these massive losses. Optoro helps companies resell excess merchandise, so its team has likely seem this happen firsthand:

- $50 billion are lost every year due to “inefficiencies with handling returns.”

- $10 billion are lost every year to “needless shipments,” such as when a product is sent to multiple warehouses instead of reaching its designated warehouse directly.

- The longer an item stays unhandled, the more it gets devalued. Products can lose up to 50% of their value within a few short weeks.

- Sometimes handling returns, especially of devalued products, is just too expensive. So companies just destroy them. That’s both a financial and an ecological loss. More on that in a bit.

$100 Billion Refunds in the Holiday Season Alone

A significant part of the challenge happens during the holiday season.

“$100 billion worth of product [was] expected to be returned between Thanksgiving and New Year” in 2019, reported Fast Company in December 2019. It added that it was an increase of $6 billion from the previous year.

A month and a half earlier, the UPS shard the number of returned packages it was preparing to handle:

- “1.6 million returns per day the week before Christmas.”

- The peak was expected to be “January 2, 2020, with 1.9 million returns taking place – a 26% increase from last year’s peak returns day.”

The UPS even has a name for January 2:

National Returns Day.

Want to see what happens inside one of UPS’ busiest days?

Check out this 2.5 minute video:

Up to 8 in 10 People Intend to Return or Exchange Unwanted Holiday Gifts

Two surveys that took place in late 2019 make it simpler to see the ease of returns for anyone gathered around the tree with loved ones.

- Out of 7,779 people, 55% said “they will return or exchange any unwanted gifts or holiday items within the first month after receiving them” (National Retail Federation).

- Out of 15,800 people, 77% “said they plan to return a portion of their gifts” (Oracle).

- And in the latter survey, 20% expected to return more than half of their presents” (Oracle).

With eCommerce getting more and more popular, there’s a reason to believe these numbers will grow.

eCommerce Refunds vs. Brick and Mortar Refunds

According to CNBC, Optoro found a difference in return rates between eCommerce and brick and mortar shoppers.

- Brick and mortar shoppers tend to return 13% of their purchases.

- Ecommerce shoppers return 15-30% of theirs.

As we’ve previously reported, expensive ecommerce products can even reach a 50% return rate.

It makes sense. Ecommerce customers can’t touch the fabric, can’t try on the outfit, can’t test a game or a device with their own hands before making a purchase.

Whether they’re buying for others or splurging on themselves, ecommerce shoppers take a bigger risk.

But it won’t stop them from buying online.

Holiday Ecommerce Refund Rates Expected to Increase Due to COVID-19

With COVID-19 in full force since March 2020, there are two forces at play.

Customers are Buying More Online than Ever Before

Between lockdowns and just trying to stay safe, customers are buying more online than ever before.

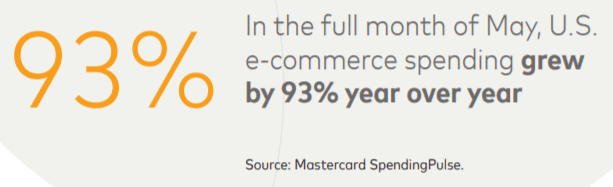

A Mastercard study revealed that:

- In May, “US eCommerce spending grew by 93% year over year.”

- “More money was spent online in the US between April and May than the last 12 Cyber Mondays combined.”

If ecommerce tends to lead to more returns, and ecommerce is growing, the number of returned products will likely grow as well.

… But Many Have Less Money to Spend

In April 2020, the International Labour Organization said COVID-19 “far exceeds the effects of the 2008-9 financial crisis.”

While people are still buying, chances are at least some of your customers will be more mindful about where their money goes.

Part of it is about making the effort to return gifts they have might have otherwise settled on.

Another part of it is to choose more carefully who they buy from.

You should also check all costs after tax with your bookkeeping software.

The Financial and Environmental Impact of Throwing Away $90 Billion Worth of Returned Products

According to the Optoro study, which was reported across major publications, there is a big gap between consumers’ expectations for refund products, and how companies actually handle them:

- Expectation: 88% of consumers think the products they return get directly sold to a store’s other customers (The Guardian).

- Reality: “$90 billion worth of product will never make it back to… stores or websites – instead, it may end up in landfills” (Fast Company).

The results are devastating for the environment, according to the study.

- “Returns generate 5 billion pounds of waste in the US landfills each year” (CNBC).

- “15 million metric tons of carbon are emitted because of returned merchandise every year” (Fast Company).

Why Companies Throw Away So Many Returned Products

Environmental journalist Adria Vasil answered this question in an interview with CBC Radio. According to Vasil, “it actually costs a lot of companies more money to put somebody on the product, to visually eyeball it and say:

- “Is it up to the standard, is it up to the code?

- “Is this going to get us sued?

- “Did somebody tamper with this box in some way?

- “And is this returnable?”

“If it’s clothing, it has to be re-pressed and put back in a nice packaging. And for a lot of companies, it’s just not worth it. So they will literally just incinerate it, or send it to the dumpster,” she added.

The Financial Return on Investment for Being Eco-Friendly with Your Returned Holiday Products

While many consumers aren’t aware of these practices, a growing number of people cares about the impact their purchases have on the environment.

“Almost 3 in 4 [people across 20 countries] say it will be important for companies to behave more sustainably,” reported Global Web Index in May 2020.

COVID-19 has driven a greater focus on both health and people’s impact on the planet. According to Global Web Index, “even if we look at audiences who weren’t interested in environmental issues prior to the outbreak, over 6 in 10 now place more importance on reducing their personal environmental impact.”

Patagonia‘s solution for the environmental and financial challenge?

Upcycling.

Or, in other words, making new clothes from clothes they can no longer repair or resell – and creating new jobs along the way.

Check out this 4 minute video to see how they do it, and then…

… let’s get back to your holiday refunds, and figure out an additional, more immediate way keep more money in your company’s pockets.

The Holiday Shopping Refund Strategy to Help You Reduce Cost and Increase Profit: Store Credit

To provide customers with a better experience, and to take care of your own bottom line, consider offering store credit to customers looking to return a product.

Instead of just giving them money, encourage them to choose another product from your store that will be a better fit for them.

Here’s how this strategy can help your company grow.

Instead of Losing Money, You Gain Cash Flow

Only issuing refunds means losing both the cost of sale and the profit you made from it. And the more this happens, the more vulnerable your company becomes in terms of cash flow.

Cash flow issues impact businesses of all sizes, now more than ever.

- 61% of small businesses “struggle with cash flow, and… 32% are unable to either pay vendors, pay back pending loans, or pay themselves or their employees due to cash flow issues” (CPA Practice Advisor).

- With lockdowns, in-store foot traffic restrictions and changes in demand, large retailers are struggling with cash flow more than ever before (Retail Dive).

The more money you keep in your pocket, the more financially secure you can keep your company, the better – always, of course, but especially now.

And that’s not the only thing you gain.

Help Customers Give You a (Second) Chance

For many customers, returning holiday gifts and products they’ve bought for themselves is part of the post-holiday shopping experience.

But you know what else is part of their post-holiday shopping experience?

Shopping.

- Out of 7,779 research participants, 74% said “they are likely to purchase something else while returning or exchanging an unwanted gift” (National Retail Federation).

They want to take advantage of post-holiday sales.

Therefore, offer to give them store credit when they return a product.

It’s an opportunity for them to give your store a second chance (or a first chance, if they were gifted the product), to see how great your customer service is, and how much joy your other products could bring them.

Harvard Business School and Bain & Company said it best: Increasing customer retention by a mere 5% can increase your profits by 25-95%.

You Might End Up Earning More than the Initial Purchase

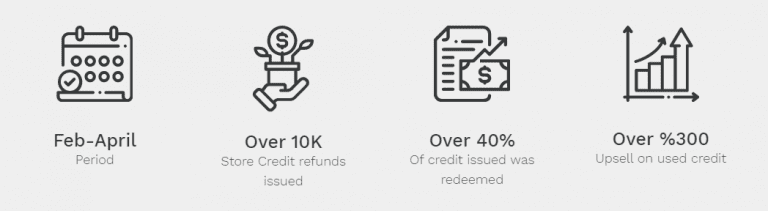

For our client Dottie Couture, switching to store credit refunds made a huge impact. Within two months, it reduced return costs by 42%.

Not only were over 40% of its store credit refunds redeemed – meaning customers were actually giving the store a second chance – but customers were buying more than the value of their first purchase.

This happens all the time. For example:

- They have a $10 credit, but they want a $30 product; or…

- They have a $10 credit, and they redeem it for a $10 product, but they add a $20 product to their cart along the way. Or two additional $10 products.

The More a Customer Buys Now, the Likelier S/he is to Buy Again

As we recently shared

- Once a customer buys a product, there’s an almost 30% chance that she’ll buy again. Once she does buy again, the chance of an additional purchase jumps to 50% (Shopify).

- The top 1% of your customers are worth up to 18x your average customers (Shopify).

As you saw above, providing store credit as a refund, especially during the holiday season, could lead you to gaining two purchases for the price of one.

That, in turn, could lead to a higher lifetime value, and maybe even advocacy.

So how do you make it happen?

Store Credit as a Refund: Best Practices for the Holiday Season and Beyond

With so many customers seeing product returns as part of the gift giving and receiving tradition, make it incredibly easy for them to find your refund policy, so you can build trust quickly.

Make your refund policy clear and concise, so it’s easy to read and understand without a lawyer.

Specifically, when it comes to store credit, include information like:

- Can they choose between a refund and store credit? Can they split it into both?

- Can they get 100% credit back?

- How long do they have to redeem the credit?

- Can they buy discounted products while redeeming credits?

- Are any products excluded from store credit purchases?

Maybe even throw in a testimonial or few from customers who’ve tried it, and ended up happy with your service.

Make it Even Easier for Customers to Return Products (Hear Us Out)

In an understandable attempt to protect their profit margins and their ability to keep their doors open, many retailers make it harder on customers to return products.

Among others:

- The return window is very small.

- Only certain products can be returned.

- Customers have to have the receipt in order to return a product.

But according to the Washington Post, “a meta-analysis of 21 research studies that together include 11,662 subjects,” conducted at the University of Texas-Dallas, discovered that could actually harm their profits.

“Overall, a lenient return policy did indeed correlate with more returns. But, crucially, it was even more strongly correlated with an increase in purchases,” the Washington Post reported.

Giving customers more time to return their products, for example, resulted in less returns and refunds.

The researchers concluded that the more time customers have…

- The less urgent it is to return the product.

- Over time, some grow attached to the product;

- Realize it’s not so bad, or

- Just decide to leave it at home in case it’ll be useful one day.

Some leading brands already do this:

Give Customers More Store Credit than the Refund Balance

Make it especially worthwhile for customers to choose store credit over traditional refunds by adding to their credit.

If they bought a $30, add $5, so they can return a $30 product and get a $35 product.

Or add $10, $500 or anything in between, depending on how much the original purchase cost them. Give them a reason to pamper themselves with a larger gift, or an additional gift.

This can work all year long, but especially in post-holiday returns.

Customers are looking for post-holiday deals.

Why not offer them one?

It’s like giving every customer a belated Christmas gift.

Remind Customers They Have Unused Store Credit

Life gets busy, and customers can forget they exchanged a gift for store credit.

Or maybe they remember, but they just don’t prioritize it in the midst of their post-holiday to-do list.

At first, it might feel like – hey, as the retailer, you got to have your cake and eat it too.

Didn’t lose the money for the refund, and got to keep both the returned product and the product the customer “should have” bought with your store credit.

It might especially feel like that if you were able to resell the original product she bought.

However, providing store credit refunds is just as much a retention and advocacy strategy as it is a cash flow strategy, if not more.

Approach it with a long term mindset.

When a customer gets a reminder, she know you could have had your cake and eaten it too.

But you chose not to.

You chose to remind her before the store credit expired.

Second, when she logs into your store, as we’ve seen above, she might actually end up buying more.

And third, if it’s a good experience, she might tell her friends they need to give you a try, too.

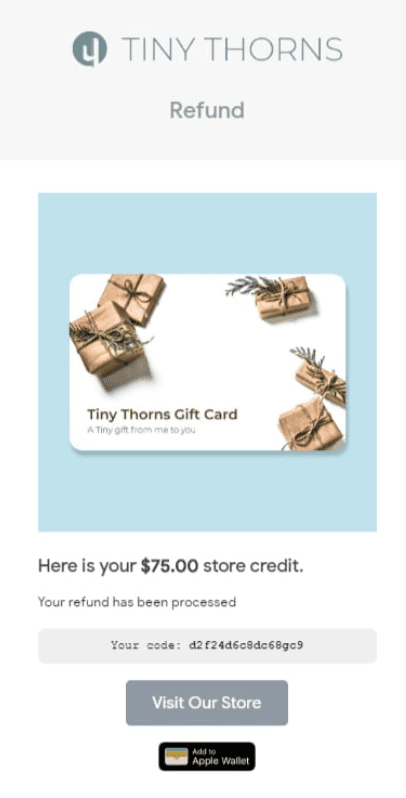

Automate the Process

Use tools to help you automate the store credit refund policy, so that it’s faster and more seamless, and there’s never a risk that someone will forget to send an email.

Reminders about unused store credit, for example, can be sent automatically when certain time has past, and customers will still feel you care.

In turn, it will leave your employees more time to focus on listening to customer challenges and practice empathy.

This way, customers who do give you a second chance end up walking away a fan.

Turn Holiday Shopping Refunds into a Retention and Advocacy Strategy

Store credit refunds can dramatically reduce your holiday refund costs, and set your store toward a more profitable new year.