If a Netflix subscription costs $9-18/month, why did Netflix invest $45 to acquire a customer? Because, at that time, a customer was worth $450 across her or his lifecycle.

Sure, some customers subscribe for one month, and some keep binge watching for years. However, understanding how much revenue the company generates on average from a single customer throughout her lifecycle – from her first purchase to the last – makes a big difference to a variety of business decisions.

Why it’s Important to Know Your Customer Lifetime Value

Understanding your customer lifetime value (CLTV) helps you make smarter business decisions, including:

- How much to invest in product development or procurement

- How much to invest in customer acquisition

- How much to invest in customer service

It can help you understand which aspects of the company need your greater focus. For example:

- How many times, on average, a customer needs to buy from you to help you reach your average CLTV, and make your acquisition and operation costs worth their while?

- What do you need to do to encourage customers to buy again?

- What can you do to increase your average order value, so you can achieve the same results with less effort – or achieve better results with the same effort?

It can help you understand which customer segments are more profitable.

- Maybe the customer segment who makes large purchases once a year looks great at first, yet the customer segment who makes small purchases every month ends up being more profitable when you look at the last three, five or ten years combined.

- Maybe you do want to invest more in the high-paying segment since a small increase there will make a bigger splash.

- Or maybe you realize that the more loyal the “small purchases” segment is, the more integrated your brand is in their everyday lives, the more their secondary revenue value increases as well – since they share their shopping joys with family, friends and social media followers.

How to Calculate Your CLTV

To calculate your CLTV, you first need to know two other metrics.

Discover your average order value:

Total revenue : number of sales = average order value(See this article for strategies to increase your AOV). Understand your average purchase frequency:

This lets you know how many purchases a customer makes on average.

Total number of orders : number of customers

= average purchase frequency

Calculate your CLTV:

Average order value X average purchase frequency

= customer lifetime value

Five Counterintuitive, But Efficient, Ways to Increase Your CLTV

Turns out that the best way to increase CLTV is to give customers gifts – or even money. And you can get creative in how you do it.

Store Credit Rewards and Gift Cards

You’ve read us praise the power of giving customers gifts to increase CLTV because we’ve seen it work over and over again – not just in research data, but in our own company, too. Our client, the Miami Heat Store, for example, emailed gift cards to fans to celebrate team victories and to encourage long lost customers to visit the store again.

72% spent more than the original gift card value, so the Miami HEAT Store’s gift card program was profitable. Very profitable, actually. It saw a 13.4X average ROI. These customers, who might not have purchased again otherwise, reengaged with the store in a fun way that increased their lifetime value. Chances are, some of them will come back soon enough to buy more.

The Miami Heat Store could have achieved similar results with store credit. The idea is similar:

- “Here’s free money as a thank you for being a customer and a fan;

- Go get yourself something at the store.”

- Then the fans log in and pile an extra item or two (or ten) on their cart above the value of their gift card or store credit. Or they get a $10 gift card, and buy a $20 item.

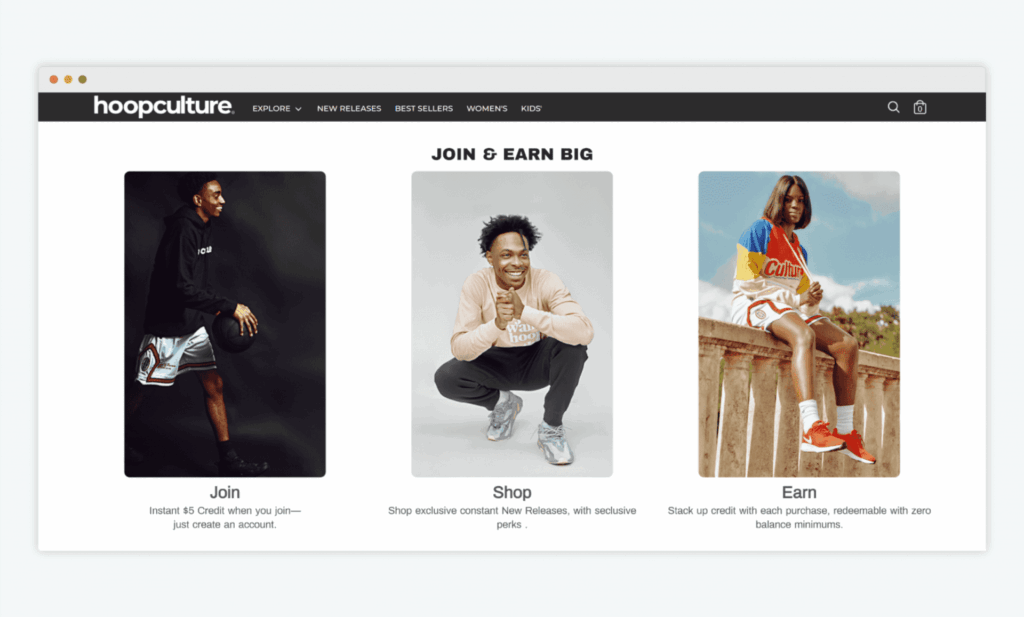

Points or Tier Based Reward Program

Of course, instead of just giving customers free money, you can have them earn it by taking desirable results, such as:

- The more they buy, the more rewards or points they earn.

- They can sign up to your newsletter or follow you on social media to unlock some rewards or points.

- They can refer other people to buy from you (more on that in a bit).

The idea is to keep them engaged with your brand.

And sure, have them purchase more and more is the ideal scenario, but not everyone is ready to purchase again right away. In this case, encouraging them to keep the relationship going – say, by signing up to your newsletter or following you on social media – gives you additional opportunities to convert them again down the line.

When you do, they’ll already have some points – equivalent to free money or a free gift – to help them get the shopping started again.

Progress-Based Rewards Program

A progress-based rewards program takes the points and rewards program to another level. It trains your customers to become your best customers, and to see your products as what helps them grow.

For example, let’s say you have a bookstore. You could run all kinds of promotions to convince customers to buy more books, hence increasing their CLTV.

But at a certain point, if they’re not reading the books, they’re going to feel worse about themselves and stop buying.

Instead, what if you…

- Created a book club.

- Ran a monthly reading challenge.

- Created Zoom parties, where every participant reads a page out loud, or discusses the book

Participation in each one of these could unlock book-related or reading-related rewards, such as:

- Store credit.

- Participating in a virtual lunch with the author whose book they’re reading.

- Gaining a community of people who, like them, are making time to read more.

This type of strategy takes your everyday customer, who might buy your product on occasion, to an avid consumer of what it is you’re selling, whose life is actually improved thanks to that.

The road from here to a much higher customer lifetime value is short – as is the road to greater advocacy.

Referral Rewards Program

Not all of your customer’s lifetime value has to come directly from her pocket. She could help generate secondary revenue by referring you to friends, family and social media followers.

Referrals have had a positive impact on new customer trust and CLTV for years. Here’s why:

- Customers who come through referrals are less hesitant to purchase more from you right away.

- Assuming they have as good an experience as the person who referred them, they’re likelier to return.

Therefore, when a customer’s friend makes a purchase, make sure you reward your original customer for helping out. If you give her store credit, she might even buy something extra herself.

For even better results, give her a gift card to give to any friend she refers.

- First, we know that gift cards encourage additional purchases.

- Second, it takes away that awkward moment, where her friend thinks her recommendation is biased because she wants the store credit. Give them both equal gifts, and they’ll connect over their mutual shopping enjoyment more organically.

Increase Your CLTV to Increase Your Bottom Line

It’s important to emphasize that the calculations in today’s guide focused on gross CLTV, but the strategies covered here can directly impact your profit growth. The cost of implementing them can be minimal, and the return on investment, as you’ve seen, is significant.

To dig deeper into your net CLTV, subtract the cost of doing business from your overall revenue, then divide your net profit by the number of customers. Costs of doing business include product development (or procurement) and service costs, customer acquisition costs and more.

Meaning:

Overall revenue – cost of doing business = net profit

Then:

Net profit : number of customers = average CLTV

Of course, one of the best ways to increase your CLTV – which the Miami Heat Store did so well – is to increase your repeat purchase rate. Check out this article to find out how to do it, and let’s increase that bottom line.