5%.

That’s how little you’d need to increase customer retention rate to increase profits by 25-95%, according to a Harvard Business School and Bain & Company study.

The study was published 30 years ago, and it’s still making waves among marketers and customer success professionals. That’s because it aligns with study after study, whose data continues to prove investing in your highest value customers is one of the simplest, most profitable strategies you can introduce to your company.

Data such as…

- It’s 9x more cost effective to retain current customers than acquire new ones (forEntrperenerus).

- Your chance of selling to existing customers is 300-1,400% higher than selling to prospective ones (Groove).

- Paying customers are almost 30% likely to make a second purchase. Once they do, there’s a 50% chance they’ll make a third one (Shopify).

- The top 1% of your customers are worth up to 18x your average customers (Shopify).

The simplest way to show your highest value customers they matter, and encourage other customers to join the party?

Start a rewards program.

What’s a Rewards Program?

A rewards program is a sort of loyalty program, although it can be used to convert new customers and encourage loyalty as well.

In a rewards program, you provide a reward (such as a discount, store credit or money back) to customers for taking a desirable action, such as:

- Making a purchase

- Buying over a certain amount

- Referring a friend

- Being a customer for a certain amount of time

You could also offer spontaneous rewards to all customers, or rewards centered around a special occasion, like Christmas.

We’ll cover the top types of rewards you can offer in your program in a bit – and we’ll even give you 29 examples from different industries – but let’s first make sure you set your rewards program for profitable success.

The Key Business Metrics to Measure in Your Rewards Program

Establishing a rewards program is similar to any other strategy or program you establish in your company. Therefore, it’s important to set key performance indicators (KPIs) that will show you the program is progressing toward the kind of contribution you’d like to see it provide for your bottom line.

As you set your goals, here are some of the key metrics we recommend including in your plan, then tracking and optimizing along the way.

- Member Acquisition Rate.

- Member Retention Rate.

- Average Order Value.

- Average Repeat Purchase Rate.

- Rewards Redemption Rate.

- Customer Lifetime Value.

- Cost of Sale.

- Customer Satisfaction.

- Customer Advocacy.

1. Member Acquisition Rate

Keep track on how many people sign up to your rewards program, if it requires registration, and how that changes throughout the year.

Keep track of what else happens in the business, so you can analyze what triggers increases and drops in member acquisition rates.

2. Member Retention Rate

If your rewards program requires official registration, analyze how long an average member remains in the program.

Then, analyze:

- What sets those who stay longer apart?

- What causes early drop offs?

If your program doesn’t require official registration, analyze:

- How often customers open emails related to your reward program, or:

- How they interact with rewards-related posts on social media.

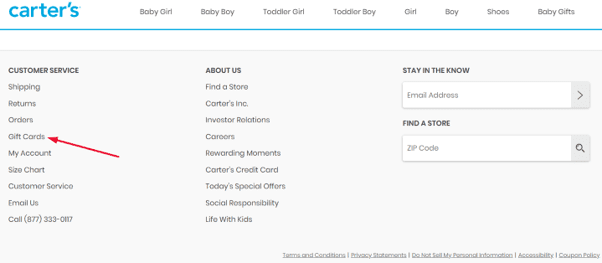

3. Average Order Value

Your rewards program, like the gift cards you supply, is meant to increase average order value. As we shared in the past, 72% of customers will spend 20% more than the value of their gift cards.

The idea is that they have free money to spend, so they can get more for the budget they already have.

Alternatively, maybe a customer logged into your store just because she got a $15 reward, but she got her heart set on an $18 product. So she spends the extra $3 – 20% – out of pocket.

Does it work with rewards that aren’t gift cards?

Yes.

We’ve seen it firsthand time and again. For example, our client Raw Threads, which provides fashion for female runners, increased average order value by 30% with automatic store credit as rewards.

To track this metric:

- Track the average order value of purchases that were done without rewards.

- Track the average order value of purchases that were done while redeeming rewards.

If you discover that your average order value is larger when rewards aren’t involved, dig further and find out why.

Sometimes it takes time to figure out the right rewards for your customers. Tracking and analyzing your data will help you pivot until you figure it out.

4. Average Repeat Purchase Rate

Of course, average order value could be especially large because it’s Christmas – or because you just gave customers a reward.

But how many of them actually come back?

We recommend tracking:

- How many customers redeem more than one reward?

- How many of them make additional purchases without getting rewarded?

Then, compare all this data to customers who haven’t redeemed rewards, to verify your program is indeed a profit center.

5. Rewards Redemption Rate

The number going around the internet is that you’re doing great if 13-14% of your customers actually redeem the reward you offer.

We think this number is a good place to start.

Especially since we’ve been super honored to be part of Only Natural Pet‘s rewards program. It got a 37.4% redemption rate within 30 days.

Our advice?

Don’t worry about averages.

Start where you are, analyze your stats, talk to your customers, consult with a professional if you need, and keep improving step by step.

6. Customer Lifetime Value

Perhaps the ultimate metric to measure is how much your rewards program increases your customer lifetime value.

In other words:

- From her first ever to last ever purchase, which customer buys more on average – the one that’s redeemed rewards, or the one that hasn’t?

Just as importantly:

- How many rewards – and what type of rewards – generate the best customer lifetime value?

7. Cost of Sale

If you give significant rewards, it’s possible you’ll get larger sales and repeat customers. But if you’re losing money because it costs you too much money to generate the sales, your company won’t be able to sustain it for long.

As you figure out how much it costs to sell a product (manufacturing, employee salaries, marketing, sales, service), count the reward as an expense. It’ll help you understand how it actually impacts your profit, and whether you need to make changes.

8. Customer Satisfaction

It might seem obvious that getting gifts equals greater satisfaction, but keep track of the feedback and reviews you receive.

- If you provide a small reward that’s only applicable to your most expensive products, you might end up creating frustration instead of joy.

- If customers love the promotion and buy more inventory that you can possibly supply at a reasonable time, you need to adjust things as well.

9. Customer Advocacy

The ultimate proof of satisfaction is advocacy.

Measure:

- How many customers who’ve redeemed rewards refer friends and family to your store? You can measure it by offering a referral program (you guessed it – with rewards!).

- How many share user generated content – posts featuring your products – on social media?

- How many are open to being interviewed for customer success stories?

Compare these metrics with those who haven’t redeemed rewards.

12 Types of Reward Programs (with 29 Examples Across Industries)

Now that you know what you want to accomplish with your rewards program, it’s time to choose a strategy that will get you there.

To help you out, here are 12 types of reward programs – with 29 overall examples, because there’s more than one way to execute each strategy.

- New Customer Rewards Program.

- Points Program.

- Store Credit Rewards Program.

- Upsell and Subscription Based Rewards.

- Tier-Based Rewards.

- Cashback Rewards.

- Paid Rewards Program.

- Progress-Based Rewards Program.

- Referral Rewards Program.

- Partnered Rewards Program.

- Rewarding Customers Who Make a Difference.

- Give Back Rewards Program.

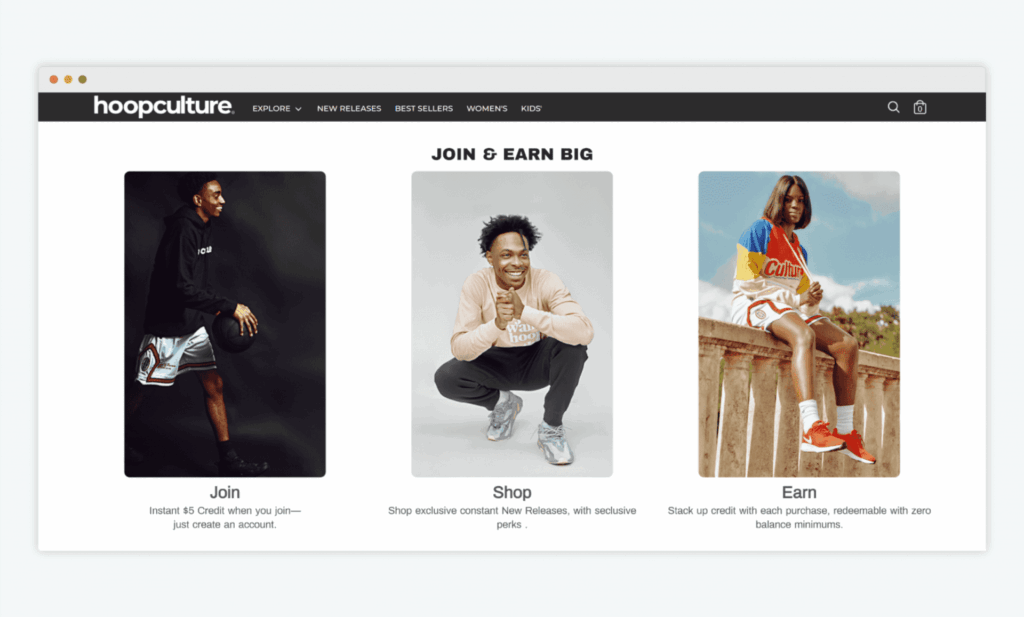

1. New Customer Rewards Program

It’s always exciting when a new potential customer walks through your virtual door. After all, you’ve put a ton of resources into making it happen.

And you know you can make that customer’s day.

Yet with new visitors abandoning sites within 15 seconds or less, it’s important to be proactive and start a conversation right away.

M.M.LaFleur, a fashion company that aims to help women “harness the power of self-representation” and “succeed in the workplace [so that] the world becomes a better place,” does that with a 15% discount.

Its primary goal? To get you on its newsletter.

This way, even if you’re not ready to buy yet, the company has a way to keep the conversation going and build a relationship with you.

But there are other ways to engage folks who are new to your brand.

Maven Meals, which is all about providing handcrafted, healthy food, suggests you start ordering right away with a $25 discount.

And Wayfair gives you a 40% discount when you sign up to its credit card.

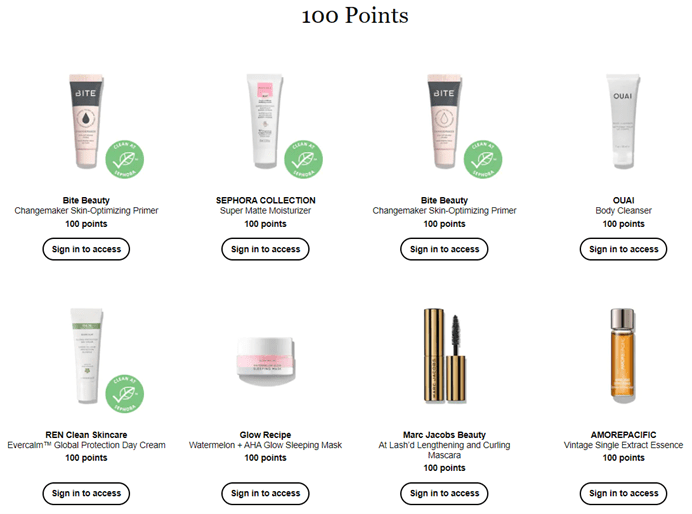

2. Points Program

When a customer makes a purchase, add some points to her account, which she can later turn into free or discounted products.

That’s a common system, but it can easily get confusing, so Chipotle explains its system concisely and clearly:

Ace does something similar, but also explains the average saving is 2%. It combines this strategy with the “new customer reward” strategy for new app downloaders.

Sephora has a “rewards bazaar,” that makes it easier to understand which products you can get for free based on how many points you’ve earned.

3. Store Credit Rewards Program

To simplify things, offer stores credit instead of points.

Consider that your points system is different than those of other stores they shop from. Therefore, redeeming a points program might be left for “later,” when customers feel like deciphering your specific points system.

This switch is exactly what Photo Boards did. Its plastic boards “give a textured effect background to your subjects,” which simplifies photoshoots, according to the site, so it made sense to simplify its rewards program, too.

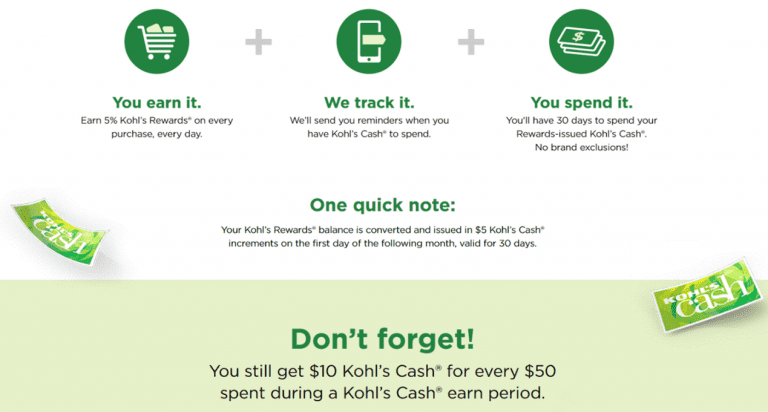

Kohl’s also offers store credit on an ongoing basis.

The New York Public Library, however, rewards only customers who buy a membership during 2020, its 125th year, with four extra months of free subscription.

4. Upsell and Subscription Based Rewards

Encourage larger purchases – one time or ongoing – and customers will end up buying more.

Milk Bar, for example, provides $10 in store credit only for orders over $75.

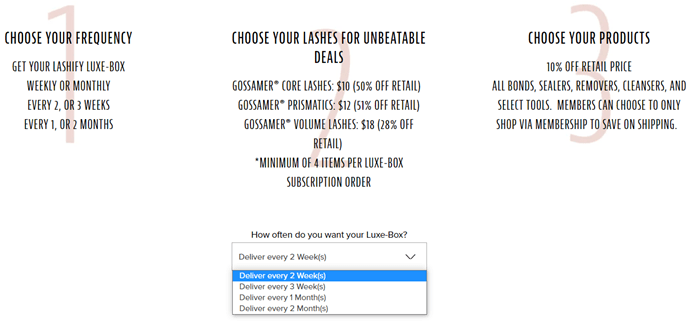

Lashify, which provides salon-quality lashes anyone can apply quickly, provides discount products to customers who sign up for a membership program – ensuring recurring revenue. It also encourages larger purchases by committing to free shipping for orders over $45 and under one pound.

5. Tier-Based Rewards

A similar program is the tier-based rewards program.

VICI, a fashion brand for affordable trendy styles, offers higher store credit the more you shop. It’s a great way to reward your most valuable customers.

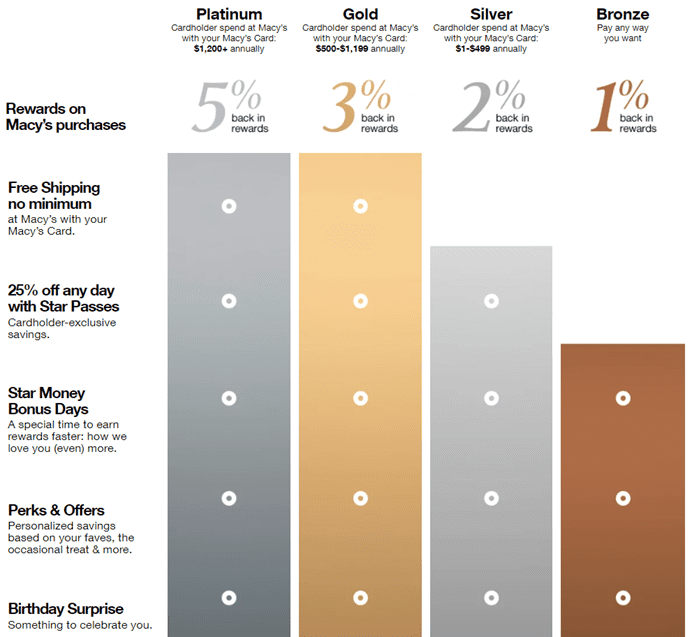

Macy’s also positions reward tiers based on spend:

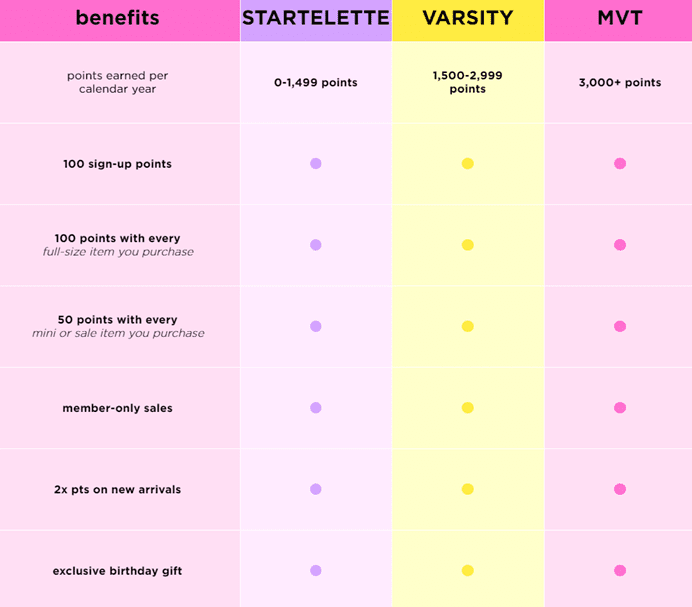

Tarte Cosmetics does it based on points, which could be confusing, but it’s a softer “sell”:

6. Cashback Rewards

You could, of course, just give customers some of their money back instead of store credit.

Factory Direct Hobbies, which provides cutting edge model railroading products and other hobby-focused products, does both.

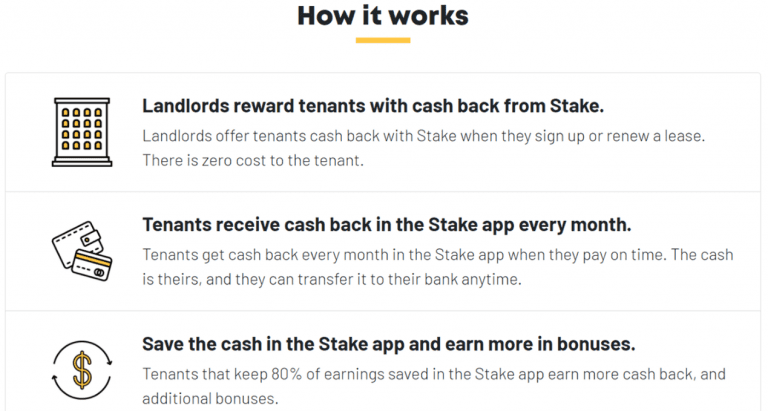

Stake takes it a step forward. It pays renters a portion of their rent back when they pay on time. They can transfer it to their bank accounts as true cashback. But if they keep 80% of the money in the Stake app, they get even more cash back, plus additional rewards.

7. Paid Rewards Program

Then again, some companies get customers to pay them for membership and benefits.

Customers who pay Bed, Bath & Beyond $29/year get 20% off every purchase, plus free shipping.

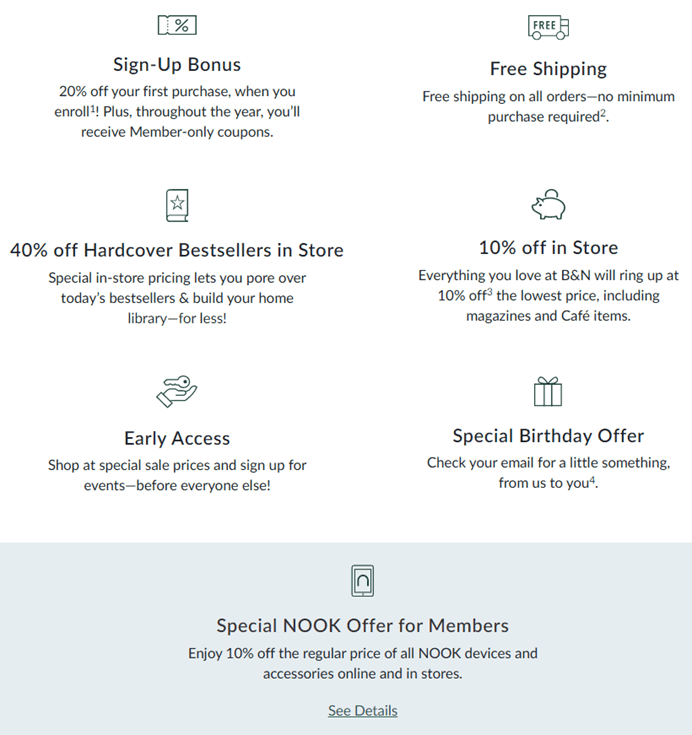

Similarly, book lovers who get the $25/year Barnes & Noble membership gain access to a bunch of benefits.

8. Progress-Based Rewards Program

Giving rewards to customers isn’t (only) about competing for the best price. It’s about encouraging customers to get involved further with your products and brand.

To do that, Apple partnered with gym chain Crunch Fitness. If you use both your Apple watch and Crunch Fitness’ app – and complete your workouts – you’ll get $3 back every week.

The better results a customer gets, the likelier she is to keep using your product and become a brand advocate.

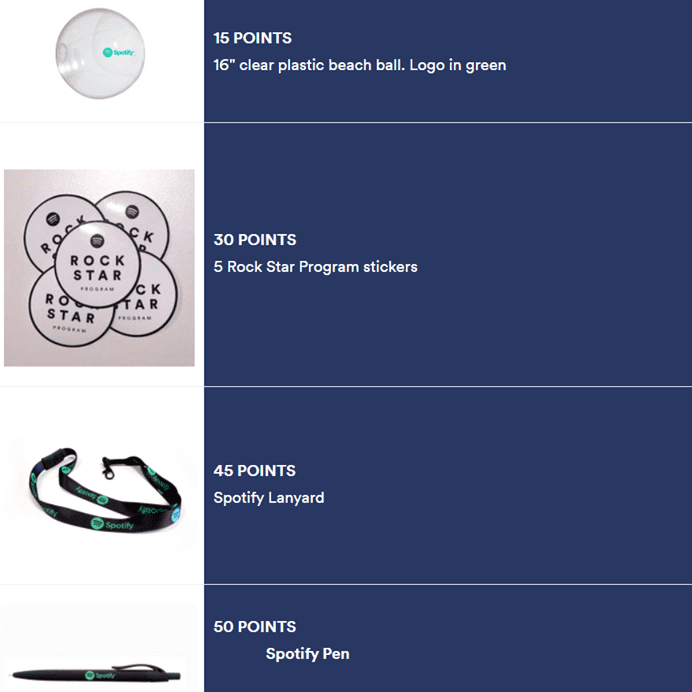

Then, to empower your brand advocates, follow in Spotify’s footsteps. The more active advocates are in the Spotify community, the more people they help reunite with music they love, the more points they accumulate in the Rock Star Program.

And points mean real rewards, including:

Besides the deeper connection you can build with advocates, customers are much likelier to buy following another customer’s recommendation than our own. Plus, the community you create will lead to stronger ties of its members to the brand.

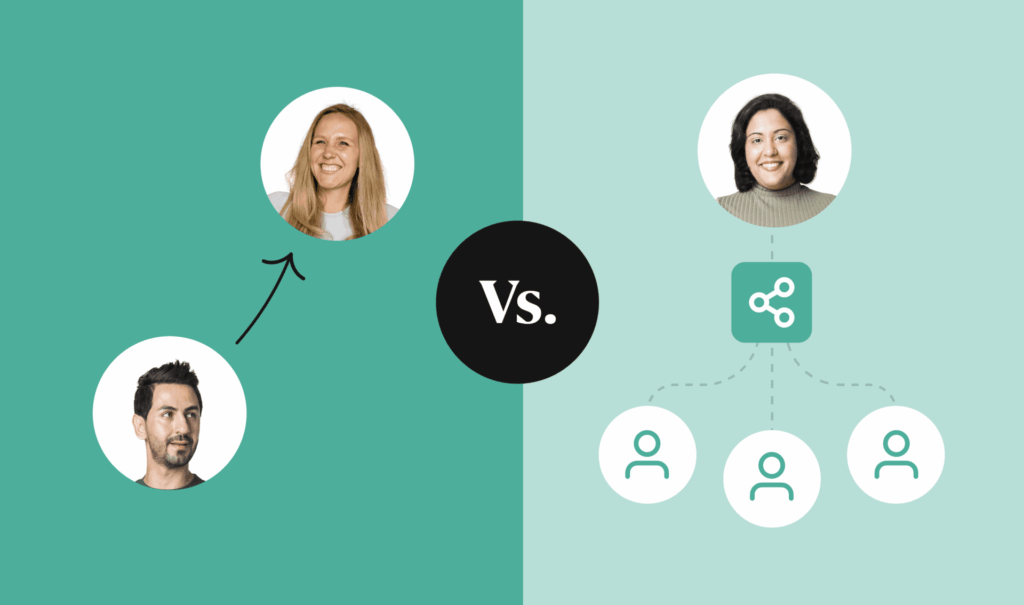

9. Referral Rewards Program

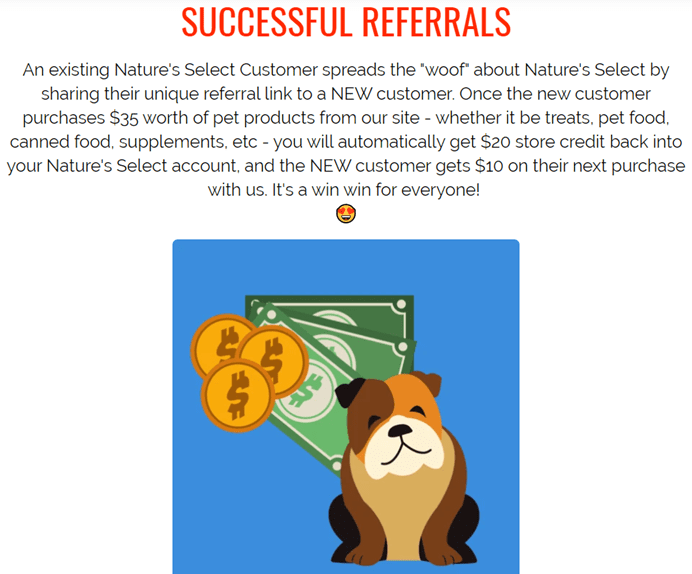

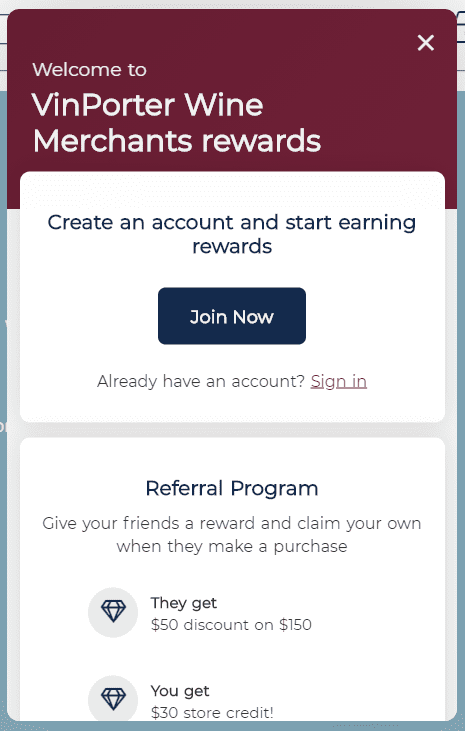

An easy way to start a customer advocacy program is to reward customers for every referral they make, that ends in a purchase.

Here are three companies in different industries. They all give rewards to both the person making the referral and the new customer.

Nature’s Select, which provides premium pet products:

KiwiCo, which provides STEAM (science, technology, engineering, arts and mathematics) project kits for kids:

And wine merchant VinPorter:

10. Partnered Rewards Program

You’re not the only one who can reward your customers.

Both Target and…

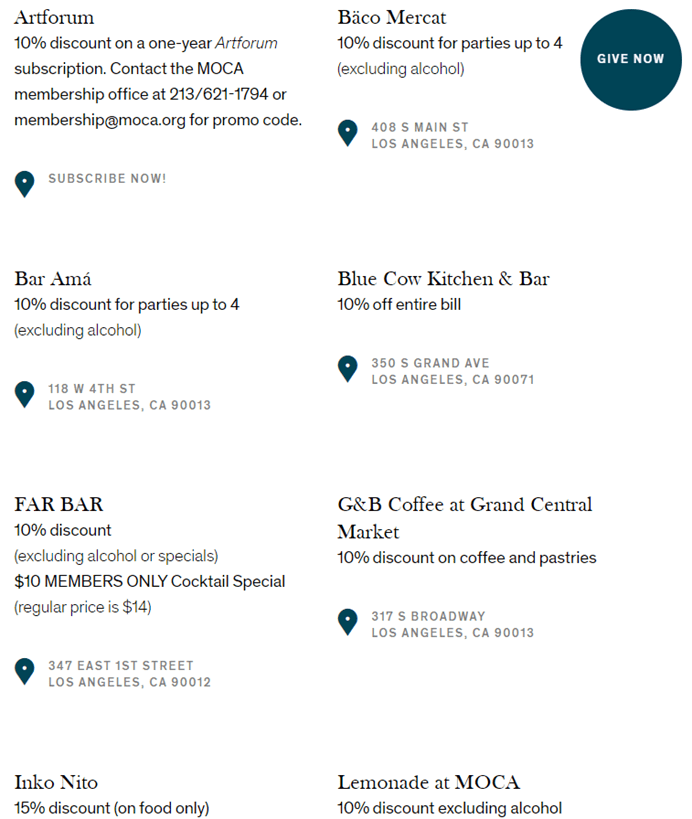

… the Museum of Contemporary Art (MOCA) cross-promote complimentary companies, who provide discounts to their customers.

11. Rewarding Customers Who Make a Difference

The NBA store provides 15% off to first responders.

Samsung offers up to 30% off for medical, police, firefighting and paramedic professionals.

When you make this kind of choice for your business, you don’t just encourage first responders and frontline workers to buy from you.

You also attract and retain customers who don’t qualify for the discounts, but who care about the values of the companies they buy from.

60% of research participants told Edelman in June 2020 that they make purchase decisions based on a brand’s stand on social issues. 82% said that brands who want to keep their trust must take a stand, and 60% said it would require brands to walk their talk and take actual action.

12. Give Back Rewards Program

Some companies do just that: They incorporate donations and social advocacy into their operations.

TOMS has been giving shoes for people in need for 13 years, and is now providing grants as well, to make a bigger impact.

Within a few months since the COVID-19 outburst, TOMS customers have helped generate $2 million for global relief efforts.

Similarly, Ben & Jerry’s has been advocating for the environment and more sustainable, conscious shopping for years. We dare you to watch this video and not be tempted to do better for the environment… plus eat all the ice cream.

Share Your Gift to Make a Bigger Impact

Starting a rewards program is complex, but exciting.

Start small. Test one strategy. Track it, analyze it and optimize it. Then, gradually, start offering more rewards, combining additional strategies, until no customer can resist your program.

Whether you offer a momentary experience of joy or a life changing product, pretty soon, the gift that drives your business and makes your products matter will enrich the lives of more people than you ever thought possible.