A merchant’s guide to growing revenue through effective Cashback rewards: It’s time to ditch discount codes and grow repeat purchases, making Cashback the cornerstone of your membership & loyalty programs.

In the rapidly evolving e-commerce landscape, Shopify merchants are grappling with skyrocketing customer acquisition costs. Traditional marketing channels no longer guarantee a positive ROI, prompting a strategic shift towards enhancing customer LTV, increasing AOV, and boosting repeat purchase rates (RPRs). In the challenging acquisition environment, improving these performance metrics have become a crucial part of business success.

In this article we discuss 3 critical factors impacting merchant growth when it comes to Cashback rewards. In addition we will outline several innovative approaches, using Rise.ai’s toolkit designed to enhance brand loyalty, increase AOV and promote a higher repeat purchases .

Fear of Cashback Leading to Potential Revenue Loss

The fear that Cashback programs could deminish revenue margins and subsequently lower the AOV over time has made some merchants wary of utilizing Cashback as an effective growth and sales strategy. This perception often stems from instances of “Cashback Abuse,” where merchants launch overly aggressive sales incentives without properly modeling their rewards system.

Yet, when implemented wisely, Cashback can actually serve as a pivotal tool to boost AOV instead of undermining it. By designing Cashback rewards that are activated for purchases above a specific threshold, merchants can ensure that their campaigns enhance, rather than compromise, their financial objectives.

A prime example of this strategy’s efficacy is demonstrated by MilkBar, which provided $10 in store credit for purchases exceeding $75. This strategy not only raised their AOV by 9% but also generated considerable upsell revenue, highlighting how MilkBar’s well-structured Cashback offers, which issued store credit above their AOV threshold, significantly elevated their financial outcomes.

Staying above your AOV threshold

using Rise.ai Cashback, 5 steps:

- Calculate your AOV.

- Set a Satisfactory Gross Margin that aligns with your business objectives.

- Incorporate additional markup to your AOV that equates to the percentage or fixed amount of Cashback you wish to offer per order.

- Utilize Rise workflows to automate the issuance of Cashback for orders that not only exceed the final markup but also possibly target LTV thresholds.

- Enhance AOV with strategic incentives: introduce delayed rewards or setting expiration dates on Store Credit.

above your AOV threshold

Discount Codes vs. Cashback

in Store Credit

Discount codes have traditionally been a popular sales driver for many merchants. However, this approach can diminish profit margins and adversely affect brand perception. Transitioning from discount codes to Store Credit based Cashback can transform customer engagement, fostering loyalty and repeat purchases without sacrificing profit margins.

Good American, one of Shopify’s most inspiring brands, is highly effective at leveraging Cashback to accelerate sales. In one of their recent seasonal promotions they adopted a “Spend Now, Earn Later” approach. Customers were offered a generous 2-week limited Store Credit offer, 7 days after their first purchase. This move not only 4X’d their RPR but also showcased the tangible benefits of opting for Cashback over discounts, showing a 35% redemption rate on issued Store Credit.

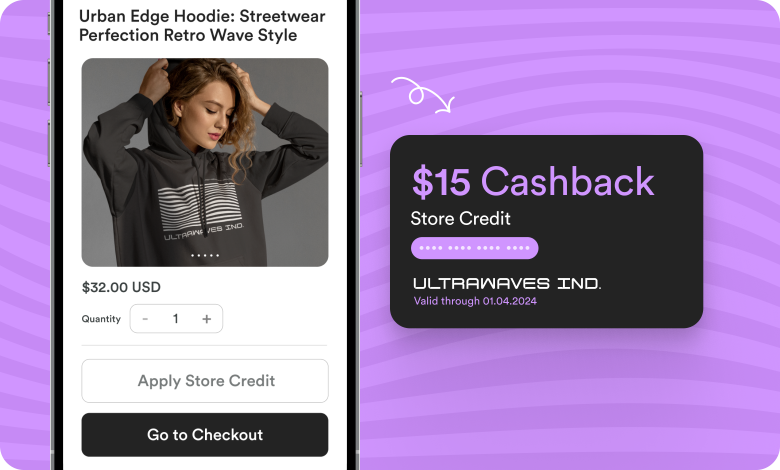

Transitioning to Cashback rewards with Rise.ai not only elevates the customer experience but also provides substantial benefits over traditional discount codes. Rise.ai offers unparalleled customization and zero friction in the redemption process, allowing merchants to deliver real value through tailored Cashback offers – targeting rewards for first-time buyers, spending levels, collection / product IDs or actions originating in other 3rd party apps.

Additionally, Rise.ai’s platform facilitates stronger repeat purchase incentives by enabling delayed rewards and setting expiration dates for specific Cashback promotions, all accumulated directly to digital wallets, ensuring customers remain engaged and loyal.

In this table we’ve outlined several key takeaways comparing Store Cashback to Discount Codes for Shopify merchants:

in Store Credit

Discount Codes

Open Loop vs. Closed Loop Cashback Systems

The choice between open loop and closed loop Cashback systems involves a strategic decision about how rewards are issued and their implications for merchant loyalty programs. Rise.ai champions the closed-loop system, crediting Cash Back directly into customers’ digital wallets. In contrast, open-loop systems issue cash or points back to the customer’s payment methods, and generally offer less flexibility and tend to dilute brand loyalty. In this method merchants often miss out on setting up the right incentives structure to encourage higher engagement with their brand.

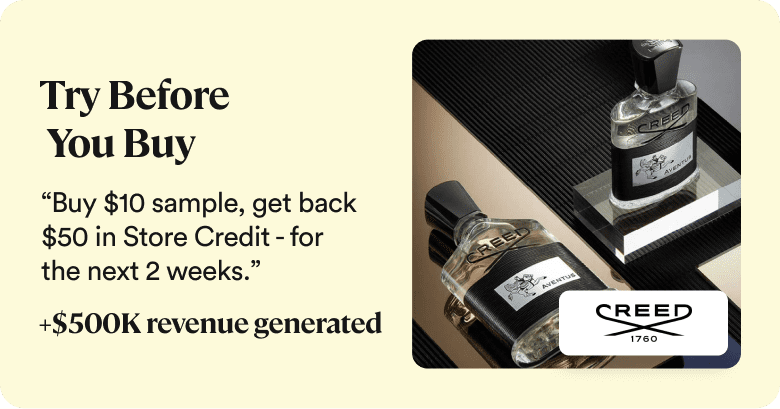

Creed’s “Try Before You Buy” campaign is a prime example of the closed-loop system’s effectiveness. By offering substantial Store Credit with sample purchases, the campaign realized a remarkable increase in upsell value, demonstrating the significant advantages of closed-loop Cashback.

Rise.ai’s Cashback solution goes beyond simple spending thresholds and merchants like Creed are using Rise.ai as an integral part of their marketing activities, executing creative strategies to grow their customer base and bottomline revenue.

Quick Cashback Strategies to Grow Repeat Purchases with Rise:

To maximize the benefits of Cashback programs and foster customer retention, Shopify merchants can easily deploy a variety of Cashback activities and drive immediate impact with some of Rise.ai’s pre-set workflows, some of these include: first-purchase rewards, AOV threshold boosters, VIP tiers and membership plays, such as, “Try before you buy” sample orders & early bird collection promotions.

These activities can be further amplified through Rise.ai’s robust integrations with partner Shopify’s apps. For example, Cashback rewards triggered by an account creation event during a customer purchase can be easily redeemed via the Status account module – In the case of LSKD, this integration alone was able to generate 197% upsell revenue on Store Credit redeemed.

Another core benefit involves leveraging detailed customer data to tailor rewards more effectively. Rise.ai’s direct integration with Klaviyo marketing flows allows merchants to add filters, conditions and unique Store Credit properties to Klaviyo flows, giving them another edge when it comes to personalizing emails and segments. This powerful combination delivers a more streamlined approach and directly impacts on redemption rates – climbing to +35% range – and RPRs for Cashback campaigns.

With Rise.ai, Shopify merchants have a powerful tool at their disposal that makes Cashback a driving revenue force and cornerstone to many loyalty and membership programs. Rise.ai’s digital wallet offers a unique advantage for merchants to extract more value from Cashback and an unparalleled customer experience with rewards easily accumulated and redeemed as branded Store Credit.