Doing everything you can to delight your customers? You’re on the right path. Considering that you’re over three times more likely to sell to existing customers than new ones, it’s a wise strategy. Moreover, your top 1% of customers are worth up to 18 times more than your average customer.

However, if your loyalty rewards aren’t hitting the mark, your efforts might seem futile. A study by LendingTree reveals that over half of customers would abandon a loyalty program if the rewards aren’t worthwhile. Consequently, finding effective ways to enhance customer loyalty for your eCommerce store can be challenging.

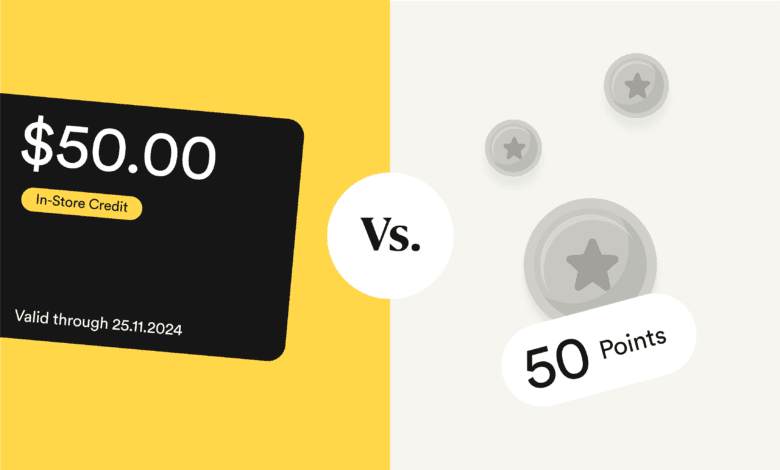

Two prevalent reward methods, store credit and points, are known for their effectiveness in driving customer loyalty. However, the ongoing question remains – which one is superior?

In this article, we’ll dissect the pros and cons of store credit and points for customer retention, making your decision easier.

Pros & Cons of Store Credit Rewards for Customer Retention

Store Credit rewards allow customers to earn ‘brand currency’ – which is equivalent to cash – for specific activities such as creating an account, referring friends, or making purchases above specific amounts and special seasonal sales. These credits can be later redeemed for future purchases using a unique code, which effectively functions as a digital wallet.

Source: Wildfire Systems

Wodbottom, a funky workout clothing brand, provides a case study for store credit rewards. Seeking more than their current 40% customer retention rate, the Wodbottom team turned to our platform at Rise. We enabled them to offer $10 in store credit for every $100 worth of merchandise purchased. The results were impressive:

- Customer return rate surged to 53%.

- Customers who used their store credit spent over 300% more than the store credit’s value.

- Average order value increased by 21%.

- Overall, Wodbottom witnessed a 513% lift in ROI.

How Automated Store Credit Rewards Increased Wodbottom’s Repeat Customer Rate by 33%

Advantages of Using Store Credit for Customer Retention

- Simplicity: Store credit systems are straightforward and user-friendly, making them attractive to customers. Customers can easily track their credit balance and understand its value.

- Flexibility: Customers can choose when and how to use their store credit, providing a personalized reward experience.

- Increased average order value: Customers with store credit are likely to make larger purchases or add extra items to their carts. Similar behavior is observed with gift cards – 72% tend to spend more than their gift card’s value.

- Reduced refunds: Store credit rewards are crucial in preventing revenue loss and enhancing customer loyalty. This strategy can be effectively managed with re-engagement tools that automate store credit rewards, saving time for customer support teams.

- Less friction and higher redemption rates: Easy, one-click redemption is becoming the industry standard, making it imperative to reduce friction for customers. This is easier to achieve with store credit, resulting in higher redemption rates.

Disadvantages of relying on Store Credits for Customer Retention

- Transactional engagement: Interaction with the system is limited to credit redemption, making store credit rewards less engaging than points-based systems.

- Impact on liability reporting: Offering store credit can impact your balance sheet liabilities section, particularly in cases of refunds and gift cards. (Special mention to your CFO).

Pros & Cons of Points-Based System for Customer Retention

A points-based system rewards customers with points for various activities, such as making purchases, writing reviews, or engaging on social media. These points can be redeemed for discounts, free products, or exclusive perks.

Consider FarmHouse Fresh, an organic and natural skincare brand that leverages points-based rewards. Customers earn 1 point for every $1 spent and additional points for following and sharing on social media, birthdays, and brand anniversaries. Once customers accumulate 200 points or more, they can cash them out for discounts, free products, or donate them to animals.

Read more about FarmHouse’s rewards program.

Advantages of Using a Points for Customer Retention

- Gamification: The competition and sense of achievement generated by points-based systems keep customers engaged and motivated.

- Customization: These systems can be tailored to align with your brand’s goals and values by assigning different point values to specific actions.

- Tiered rewards: Points-based systems often have multiple reward tiers, giving customers a sense of progression and resulting in increased brand loyalty.

Disadvantage of Using a Points for Customer Retention

- Lack of transparency: Customers often find it confusing to understand the worth of their points in terms of dollar value.

- Increased customer friction: Points-based systems can be more complex, potentially leading to confusion and lower engagement.

- Limited redemption options: Unlike store credit, points-based rewards may have restrictions on what customers can redeem them for, limiting their appeal.

Store Credit vs. Points for Customer Retention: The Data Insights

- 75% of participants in a LendingTree survey cited “ability to earn points” as the primary reason for joining loyalty programs.

- Contrarily, 79% of participants in an Ebbo survey expressed disinterest in accumulating points.

- 81% of customers are more likely to purchase from an online store offering rewards or cashback (Wildfire Systems).

- More brands see increased revenue via rewards (36%) compared to discounts (28%), with at least 5% instant cashback resulting in greater sales impact (Aberdeen Group and Dosh via Forbes).

- 61% of customers planned to give cash or a gift card as a holiday gift in late 2022 (MassMutual via NASDAQ).

Store Credit vs. Points for Customer Retention: Making the Best Choice

Both store credit and points-based reward systems have their own strengths and weaknesses. Store credit systems, with their simplicity and flexibility, are an excellent choice for merchants wanting an easily understandable rewards program. On the flip side, points-based systems, with their gamification elements, are ideal for merchants seeking a more dynamic and interactive loyalty program.

To decide between these two systems, consider your brand’s objectives, your customer base, and the resources you have available to manage and promote the program.

A hybrid approach, combining elements of both systems, might provide a more comprehensive and versatile rewards experience. As per McKinsey, companies offering a points-plus-cash option saw redemptions increase by 20 to 25%.

Whichever reward system you choose, ensure it aligns with your business objectives, resonates with your customer base, and contributes to fostering long-lasting relationships with your customers, thereby enhancing their lifetime value.

By creating a loyal customer base that not only contributes to your store’s success but also champions your brand, you’ll be setting your business up for sustainable growth.