While the holiday season may feel far away, if you’re a Shopify merchant, there’s no better time to start preparing for Black Friday and Cyber Monday (BFCM) than right now. By setting up cashback on your eCommerce store via Rise, you can make customers more likely to spend now and spend even more during the holidays.

We’re giving you the scoop on how cashback incentivizes repeat purchases and sharing winning cashback strategies for Shopify merchants that will help you have your most lucrative Black Friday and Cyber Monday yet.

How Cashback Keeps Customers Coming Back for More

As an eCommerce merchant, you have many tools at your disposal for encouraging customers to make repeat purchases, like discounts and loyalty points. However, cashback is one of the best incentives for repeat purchases because it’s simple and doesn’t devalue your brand.

Sure, you could offer customers rewards through loyalty points, but they don’t want to go through the headache of calculating how many points they need to reach a reward. Customers may avoid engaging with your loyalty program altogether to avoid doing mental gymnastics.

You could alternatively give customers discounts, which is common during BFCM, but doing so will dilute your brand and make customers used to looking for discounts. This behavior can lead to a vicious discounting cycle that can seriously impact your bottom line.

Cashback is the best solution for driving repeat purchases leading up to – and during – BFCM because it’s intuitive, doesn’t cut into your profits, and fosters true loyalty. Here’s how:

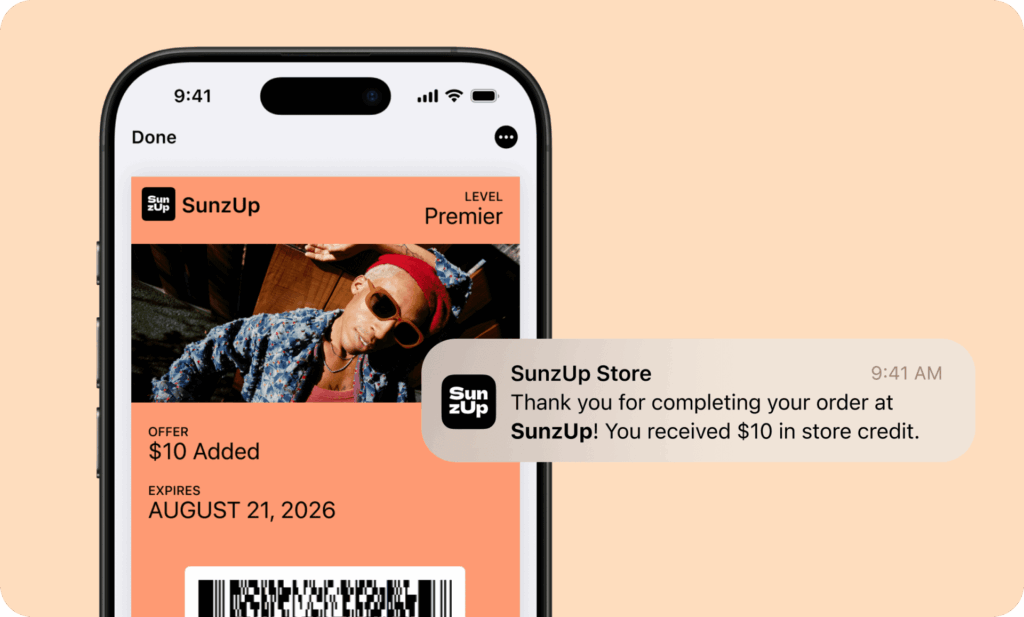

- Simplicity: A cashback program could be as simple as “$10 cashback in store credit for every $100 customers spend.” It’s intuitive and easy for customers to figure out and for merchants to manage.

- Profitability: Workflow settings from Rise.ai simplify cashback implementation and ensure these rewards don’t cut into the bottom line thanks to settings like average order value (AOV) thresholds.

- Loyalty: Unlike discount codes, which encourage one-off purchases, cashback – especially when combined with delayed rewards and expiration dates – helps customers create a habit of shopping with your brand.

| Advantages of Cashback

in Store Credit | Disadvantages of Discount Codes | |

|---|---|---|

| Revenue Generation | Cashback rewards encourage repeat purchases. Good American saw a 4x increase in RPR with a 2-week expiration. | Instant discounts cut directly into profit margins, potentially harming financial health. |

| Customer Loyalty | Offering Cashback as a post-purchase reward creates a positive shopping experience, making high-value products more accessible. | Discount codes often lead to one-off purchases rather than fostering an ongoing relationship. |

| Conversion Rates & Data Analysis | Dr. Squatch observed a 32% increase in conversion rate for new subscribers within 60 days, showcasing the effectiveness of personalized engagement. | Limited Data: Discounts provide less insight into customer preferences compared to Cashback, which can yield valuable first-party data through interactions. |

Cashback to keep you

above your AOV threshold

7 Winning Cashback Strategies for Shopify Merchants to Implement NOW

Now that you get the hype about cashback, here’s how to make it your superpower during this BFCM season. Without further ado, here are seven winning cashback strategies Shopify merchants should implement ASAP.

01

Cashback-Based Loyalty Programs

As you know, points-based loyalty programs are just plain confusing! When customers don’t understand how far they are from a reward, they’ll be less likely to join and engage with your loyalty program.

Instead of building a points-based loyalty program, reward loyalty program members with cashback in the form of store credit. Offering a tiered loyalty program that gives more cashback to members who have reached certain spending thresholds incentivizes customers to spend more to earn more.

For example, you could give your general membership base 1% cashback as store credit, and VIP members who have spent at least $500 with your shop 3% cashback as store credit. When customers reach VIP status, they’ll get even more back during BFCM.

02

Limited-Time Cashback Promos

Create limited-time promotions that give customers the chance to earn extra cashback. This strategy creates a sense of urgency for people to pull the trigger on something that’s been in their carts and gives them some spending money to use later during BFCM.

A great example comes from women’s boutique VICI, which offered a 30% extra Cashback promotion for a specific 24-hour period. This strategy spiked sales and was paired with a social media campaign, where followers could win a $250 VICI Bucks gift card by tagging friends. The result? Increased sales, more newsletter subscribers, and a highly engaged audience – proof that limited-time Cashback promos can create instant momentum and long-term loyalty.

03

Cashback Expiration Dates

According to the psychological principle of loss aversion, the pain of loss hurts doubly more than the pleasure of gaining something of equal value. Take advantage of this bias during BFCM prep by setting expiration dates on the cashback that customers earn.

Expiration dates create a sense of urgency for customers to come back to your store and use their cashback before they lose it. Choose Black Friday or Cyber Monday as expiration dates for cashback to get customers to shop at the right time.

04

Delayed Rewards

Delaying rewards is a clever way to encourage customers to make a habit of regularly shopping with you so that they come back for BFCM. When customers receive their cashback rewards a few days or weeks after earning them, they have a reason to come back to make a purchase. Staying top of mind pays off big during the BFCM rush.

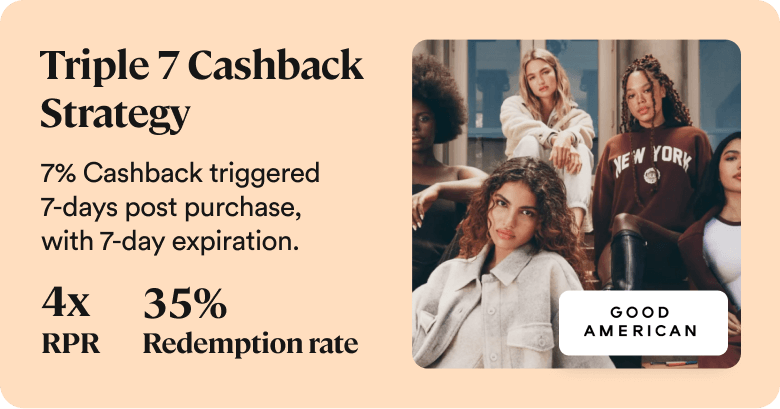

Take inspiration from denim brand Good American, which created a “spend now, earn later” cashback campaign that sent customers a cashback reward one week after purchase. Good American saw a 35% redemption rate for the promotion and a four time increase in repeat purchase rate.

05

Try Before You Buy

With Try Before You Buy, customers purchase a sample product and then receive the amount they paid for the sample as cashback store credit to use at a later time.

Fragrance brand Creed gave customers who bought $10 samples of their scents $10 back in store credit to use within two weeks. This urgency got customers to pull the trigger instead of letting the cashback sit unused in their accounts. With this strategy, Creed generated more than $500,000 in revenue.

While Try Before You Buy is popular in the beauty world, all kinds of businesses can benefit from it. Think about how you can apply this cashback program to your store in the lead up to BFCM.

06

AOV Threshold Boosters

Incentivize customers to spend more by dangling carrots of extra cashback in front of them in exchange for larger orders. Implement a base cashback amount, and then increase it as customers spend more.

For example, you could offer $5 cashback for purchases between $25 and $50, $10 back for purchases between $51 and $75, and $20 back for purchases of $76 or more. This upselling strategy encourages customers to buy more now. And, when you delay the cashback reward, it also encourages them to create a habit of regularly visiting your store, which will pay off during BFCM.

Staying above your AOV threshold using Rise.ai Cashback, 5 steps:

- Calculate your AOV.

- Set a Satisfactory Gross Margin that aligns with your business objectives.

- Incorporate additional markup to your AOV that equates to the percentage or fixed amount of Cashback you wish to offer per order.

- Utilize Rise workflows to automate the issuance of Cashback for orders that not only exceed the final markup but also possibly target LTV thresholds.

- Enhance AOV with strategic incentives: introduce delayed rewards or setting expiration dates on Store Credit.

07

Cashback for Special Products

Prompt customers to buy certain products, such as your new collection or items that are selling slowly, by offering additional cashback for them. This strategy boosts purchases of targeted items and gives customers money to spend when they come back for Black Friday or Cyber Monday.

Take inspiration from kitchen appliance brand Thermomix, which offered $75 cashback in the form of store credit when customers shopped from their new collection. This promotion led to an impressive $400,000 in upselling revenue for the brand.

Your Shopify Store + Rise.ai Cashback = a Winning BFCM Strategy

Okay, so now you’re on the cashback bandwagon, but you have no idea how to implement all of these amazing strategies on your Shopify store. Fortunately, Rise.ai makes these cashback strategies for Shopify merchants so easy to implement and manage. From AOV value thresholds that help you stay profitable to in-cart nudges to boost purchases and one-click cashback applications at checkout, Rise. ai has you covered. To see Rise.ai in action on your storefront, request a demo today.